Graph migration to L2

The Graph protocol is midway through its migration to L2 on Arbitrum. That means that graph indexers on ETH mainnet are moving over to the Arbitrum chain and any staked GRT tokens on mainnet also need to be manually migrated to Arbitrum.

State of Staking | Q2 2023

Crypto Rebounds Sharply Amid Bank Failures and Regulatory Crack Down

Despite a challenging macro environment, the closure of several systemically important crypto banks, and regulatory action against industry leaders, the crypto market started 2023 with a bang. This after the FTX implosion dragged the market to a multi-year low in Q4 2022. Crypto assets increased by ~ 50%+ Q/Q across the board, reaching their highest levels in the last year. Driven by regulatory action against Binance's bUSD and US bank failures, stablecoins were the only asset class to buck the positive trend. Stablecoins shed another $7BN Q1 2023, after losing $11BN in Q4 2022.

ETH Shapella Upgrade Guide for Staked Customers

On April 12th at ~ 6:27 PM EST the Ethereum network will upgrade via the Shanghai and Capella ("Shapella") hard forks. The Shapella forks will enable transfers between Ethereum's consensus and execution layers. This will make it possible to access staking rewards, exit from the validator set, or un-stake and withdraw funds.

Shapella allows stakers to upgrade their withdrawal credentials from BLS to ETH keys. Stakers must upgrade the credentials for all their validators to access rewards, un-stake or withdraw funds.

ETH Merge: Impact to Stakers and Staked’s Customers

Sometime during 09/10/22 - 09/20/22, the Ethereum Mainnet will merge with the Beacon Chain proof-of-stake (PoS) system. This will mark the end of proof-of-work (PoW) for Ethereum, and the full transition to PoS. Staked will manage the entire validator upgrade process, including the addition of MEV software to earn MEV fees. No action is necessary for stakers.

Transfers and withdrawals of ETH from the Beacon Chain will remain disabled until the Capella hard fork, 3 - 6+ months post merge. As a result, staked ETH and validator rewards on the Beacon Chain will remain locked until then.

Post-merge, Ethereum validators will continue earning rewards for block proposals and attestations. Importantly, validators will also start earning the transaction fees and MEV currently earned by PoW miners.

Unfortunately, the ETH2 key (BLS) used for the withdrawal credentials in staking deposits can't receive funds. These addresses are only designed for signing consensus messages, but can’t sign transactions. The option to upgrade from ETH2 credentials to a standard ETH address on-chain will be available in the Capella hard fork, 3 - 6+ months post merge.

For security purposes, Staked can only distribute the transaction fees and MEV to verified ETH addresses. As a result, stakers will earn the new fees and MEV, but won't receive them until upgrading their withdrawal credentials on-chain. A complete accounting of all validator rewards will be available via Staked’s reporting.

Stakers who used a standard ETH address in their staking deposit will receive the new fees and MEV on a bi-weekly cadence immediately post-merge.

To account for the new fees and MEV earned by validators, Staked will be moving to a commission-based pricing model. Post-merge, Staked will charge a 10% commission on all rewards and fees earned by validators (validator + transaction fees + MEV). Stakers will earn 90% of all rewards and fees. Staked will cancel all existing recurring subscriptions as of the merge.

Staked will charge a percentage that is equal to 10% of all rewards (validator + transaction fees + MEV). To remain non-custodial, Staked will collect this fee from the transaction fees and MEV earned by the validator (and not from the rewards distributed at the protocol layer to the validator). All rewards distributed at the protocol layer to the validator (sync committee, block proposals and attestations) will continue accruing to the validator. Because Staked will charge this fee on the transaction fees and MEV only, the percentage will be higher than 10%.

Stakers on the 1-time payment plan will only pay a 10% commission on transaction fees and MEV until transfers are active. They will not pay a commission on validator rewards (sync committee, block proposals and attestations). Once transfers are active, Staked will charge a 10% commission on all rewards and fees earned by all stakers.

Tornado Cash Sanctions

Staked believes in the importance of crypto being censorship-resistant and permissionless. As a leading ETH validator we are carefully monitoring the discussion on the potential implications of Tornado Cash sanctions for validators.

FAQs

- Does Staked plan to support the upcoming hard fork on Ethereum?

-

- Yes, Staked will be supporting the "Merge" when it happens sometime during 09/10/22 - 09/20/22.

- Do I need to do anything with my validators for the Merge?

-

- No action is necessary for stakers. Staked will manage the entire validator upgrade process, including the addition of MEV software to earn MEV fees.

- Can I withdraw ETH that I’ve staked in the past?

-

- No, unfortunately not yet. You will be able to withdraw your staked ETH after the Capella hard fork, 3 - 6+ months post-merge.

- Will stakers earn transaction fees (i.e. tips) post-merge?

-

- Yes, stakers will earn 90% of all transaction fees post-merge. Staked will keep 10% of all rewards earned as a commission (validator rewards, transaction fees and MEV).

- Does Staked plan to operate MEV software for its validators? Will stakers earn the MEV fees?

-

- Yes, Staked will be adding MEV software (MEV-Boost) as part of the merge upgrade. Stakers will earn 90% of the MEV.

- Will I receive the transaction fees and MEV right away after the merge?

-

- No, you will earn the transaction fees and MEV. However, you won't receive them until you have upgraded your ETH2 withdrawal credentials to a standard ETH address on-chain. The option to upgrade to a standard ETH address on-chain is planned for the Capella fork, 6 - 9+ months post-merge.

- Can I change the withdrawal address for my validators?

-

- The option to change your withdrawal address will be available on-chain via the Capella fork, 3 - 6+ months post-merge.

- Where will the transaction fees and MEV go until the Capella fork adds support for ETH1 addresses?

-

- Transaction fees and MEV will accrue on-chain at the fee recipient address set for the validator.

- Does Staked plan to block or censor OFAC sanction transactions for the validators that it operates?

-

- Staked believes in the importance of crypto being censorship-resistant and permissionless. As a leading ETH validator we are carefully monitoring the discussion on the potential implications of Tornado Cash sanctions for validators.

RAY Wind-Down

As a result of regulatory uncertainty in the United States, Staked will be shutting down the Robo-Advisor for Yield service (RAY) on November 1, 2022. RAY was an innovative experiment that worked well for depositors. Every depositor made money, earning a higher yield than they would have elsewhere. We’re disappointed that RAY will be shut down, but the landscape has evolved rapidly and the cost of dealing with undefined regulations is too great.

We kindly request that you withdraw your funds from RAY as soon as possible. On November 1, 2022, we will use our administrative keys to return all deposits to depositors, remove access from the Staked.us website and turn off the oracles that update RAY on a regular basis.

The RAY smart contracts remain open source and available for anyone to carry the torch. The Github repo is available here: https://github.com/Stakedllc/robo-advisor-yield

Stake SOL, Earn Rewards

Seeking Yield by Staked - Issue 96: ⛓️ Tracking ETH2, ✅ Solana Rewards, 📊 State of Staking Report Q1 2021, 📊 Current Staking and Lending Yields, & More

February 2 ETH2 slashing event - Post-mortem

TLDR

Staked chased technical performance over double-signing robustness and that’s not a good trade off. No customers were harmed in this interaction but it was an expensive lesson for Staked and we are sharing our learnings in case they help others.

$4 billion worth of ETH staked

Seeking Yield by Staked - Issue 95: ⛓️ Tracking ETH2, 🖥️ State of Staking Webinar Recording, 📊 State of Staking Report Q1 2021, 📊 Current Staking and Lending Yields, & More

State of Staking

Seeking Yield by Staked - Issue 94: ⛓️ Tracking ETH2, 📊 State of Staking Report Q1 2021, 📰 Staked Media Mentions, 🖥️ State of Staking Webinar, 📊 Current Staking and Lending Yields, & More

2.5 million ETH Staked

Seeking Yield by Staked - Issue 93: ⛓️ Tracking ETH2, 📰 Staked Media Mentions, 🖥️ State of Staking Webinar, 📊 Current Staking and Lending Yields, & More

$2.7b worth of ETH deposited

Seeking Yield by Staked - Issue 92: ⛓️ Tracking ETH2, 📰 Staked Media Mentions, 📱 Elrond Maiar Wallet, 📊 Current Staking and Lending Yields, & More

$1b worth of ETH staked

Seeking Yield by Staked - Issue 91: ⛓️ Tracking ETH2, 📰 Staked Media Mentions, 🎉 The Graph Network Mainnet, 🖥️ ETH Staking Webinar Recording, 📊 Current Staking and Lending Yields, & More

1.4 million ETH staked

Seeking Yield by Staked - Issue 90: ⛓️ Tracking ETH2, 📰 MEW Partnership + Staked Media Mentions, 🎵 AUDIO Staking, 🖥️ ETH Staking Webinar, 📊 Current Staking and Lending Yields, & More

ETH2 Phase 0 is live! ✅

Seeking Yield by Staked - Issue 89: ⛓️ Tracking ETH2, 📰 Staked Media Mentions, 🖥️ Livepeer Explorer Update, 🌉 Secret Network Ethereum Bridge, 📊 Current Staking and Lending Yields, & More

143k ETH deposited

Seeking Yield by Staked - Issue 88: ⛓️ Tracking Eth2, 🤝 Blockstack Stacking Support, 🎉 Oasis Mainnet Launch, 📊 Current Staking and Lending Yields, & More

62k ETH deposited

Seeking Yield by Staked - Issue 87: ⛓️ Tracking Eth2, 📰 Staked Media Mentions, 🖥️ ETH Staking Webinar, 📊 Current Staking and Lending Yields, & More

Eth2 Deposit Contract

Seeking Yield by Staked - Issue 86: ⛓️ Tracking Eth2, 📈 Elrond Mainnet Milestones, ⚖️ The Graph Network Governance, 📊 Current Staking and Lending Yields, & More

ETH2 deposit contract is imminent

Seeking Yield by Staked - Issue 85: ⛓️ Tracking ETH 2.0, 🤝 Audius Builds on Solana, 🎉 1,000 tBTC, 📊 Current Staking and Lending Yields, & More

Two Weeks...

Seeking Yield by Staked - Issue 84: ⛓️ Tracking ETH 2.0, ✅ NEAR Staking Rewards, 💲 USDC on Solana, 📊 Current Staking and Lending Yields, & More

NEAR is here ✅

Seeking Yield by Staked - Issue 83: ⛓️ Tracking ETH 2.0, ✅ NEAR Mainnet Phase II, 🖥️ Earning with BTC and ETH Webinar, 📊 Current Staking and Lending Yields, & More

Staked August 2020 Update

August 2020 recap — Stay updated with Staked monthly updates!

Synthetix Rewards - Week Ending September 2, 2020

Due to record high gas prices on the Ethereum network, Staked will not be claiming Synthetix rewards for this week’s claim period. Gas prices have been 200+ gwei for the past week, and ~ 450 for the past 24 - 48 hours. Since the gas costs for the claims transactions are greater than the value of the rewards, it’s not economically rational to execute the claims transactions. Delegates can claim their own rewards until Wednesday September 2nd, 2020 at 4:30 AM EST via https://mintr.synthetix.io/. We sincerely apologize for the inconvenience.

Staked July 2020 Update

July 2020 recap — Stay updated with Staked monthly updates!

Validator Views: Polkadot Update - July 22, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Minimum SNX Delegation for Synthetix Rewards Management Service

Due to the sharp increase in gas prices on the Ethereum network, Staked has implemented a minimum SNX delegation requirement of 2,000 staked SNX for our Synthetix rewards claiming and c-ratio management service effective today, Wednesday July 22nd.

RAY Upgrade: Gas fees down 75% and ERC-20 compatible

RAY recently got an upgrade! We've converted RAY to the ERC-20 standard, had those changes audited by Trail of Bits, and are now rolling it out.

Staked June 2020 Update

June 2020 recap — Stay updated with Staked monthly updates!

Validator Views: Kyber Network Update - July 7, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Validator Views: SKALE Update - July 1, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

RAY Now Incorporates Liquidity Incentives

TLDR: RAY depositors get all the benefits of supplying funds to the underlying protocols, including any liquidity incentives.

Validator Views: Polkadot Update - June 18, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

RAY (Robo-Advisor for Yield) Scheduled Maintenance Update

Scheduled Maintenance Update

Staked May 2020 Update

May 2020 recap — Stay updated with Staked monthly updates!

Synthetix Rewards on Auto Pilot: Never Let Rewards Expire Again

RAY (Robo-Advisor for Yield) Now Supported on imToken

Staked April 2020 Update

April 2020 recap — Stay updated with Staked monthly updates!

Validator Views: Keep Network Update - April 29, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Validator Views: Celo Update - April 28, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Validator Views: Celo Update - April 21, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Validator Views: ETH 2.0 Update - April 17, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Validator Views: Celo Update - April 15, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Validator Views: ETH 2.0 Update - April 7, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Validator Views: Polkadot Update - April 9, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Validator Views: Keep Update - March 31, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Staked March 2020 Update

March 2020 recap — Stay updated with Staked monthly updates!

RAY (Robo-Advisor for Yield) Support for Aave

RAY (Robo-Advisor for Yield) now supports on-chain lending to Aave for ETH, DAI and USDC.

Validator Views: ETH 2.0 Update - March 26, 2020

The purpose of Validator Views is to provide updates and information regarding proof of stake chain progress, timelines, and more.

Staked Monthly Update

February 2020 recap — Stay updated with Staked monthly updates!

How Does Staked Avoid Slashing Risk?

Staked spends a ton of time and money ensuring that our delegators will never get slashed. Our two-year track record with no slashing events across 18 networks is a good testament, as is our 100% uptime SLA. This blog post goes deeper on the tech that backs up those claims.

Cosmos (ATOM) Staking & Delegation Guide

The Cosmos Hub mainnet officially launched on Wednesday, March 13th, 2019 at 7 PM EST (23:00 UTC).

Dash (DASH) Staking Guide

Summary

Staked provides a service that allows holders of Dash to get the benefits of running a masternode without the upkeep, while allowing holders to maintain custody of their crypto assets.

Decred (DCR) Staking Guide

Summary

Decred (DCR) is a cryptocurrency with a hybrid proof-of-work (PoW) / proof-of-stake (PoS) consensus mechanism and an on-chain governance system. The current yield for staking DCR is 8.3% annually.

Livepeer (LPT) Staking Guide

Summary

Livepeer offers a very attractive staking yield: currently ~ 77% on an annualized basis.

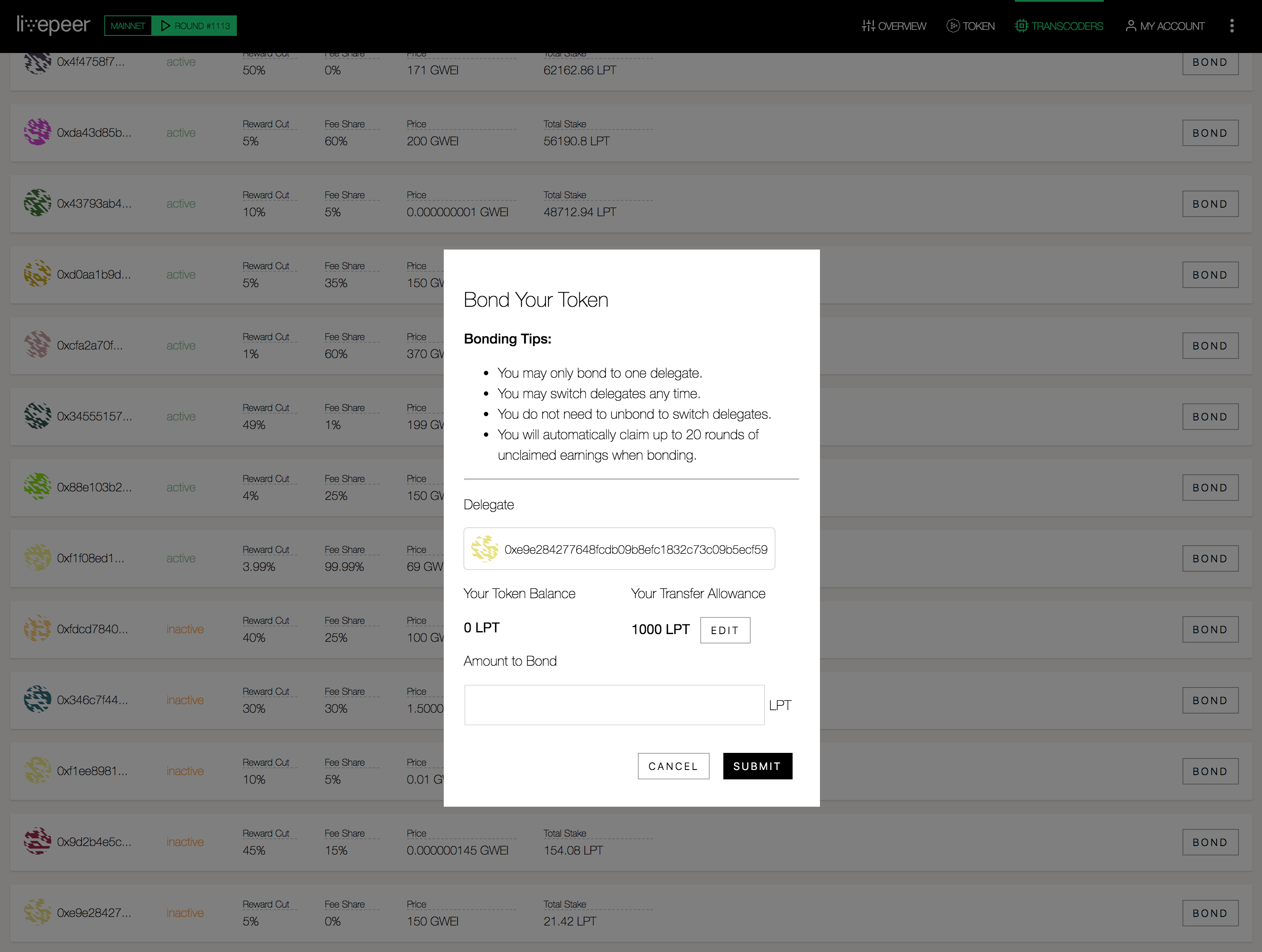

If you own Livepeer (LPT), it’s advisable to bond it to a transcoder so that you can earn the staking yield. To delegate your LPT to Staked, please use the following address:

0xe9e284277648fcdb09b8efc1832c73c09b5ecf59

Delegation is non-custodial, delegates cannot spend your LPT, and your stake is not at risk.

Overview

Livepeer aims to decentralize live video broadcast by developing a live video streaming (p2p) network protocol and infrastructure layer on the Ethereum blockchain. The Livepeer protocol is designed to incentivize game theoretically secure, performant and scalable transcoding and distribution of live video. The Livepeer alpha network launched on the Ethereum mainnet on May 1, 2018.

The Livepeer protocol is round based, where each round lasts roughly one day. Token holders delegate their stake to elect transcoder nodes that perform video transcoding work.

At the completion of each round, broadcaster fees and newly minted (via inflation) LPT are distributed, transcoders are slashed (penalized with loss of funds) for any malicious activity, and the active transcoder pool is reset based on total delegated stake, all programmatically at the protocol level.

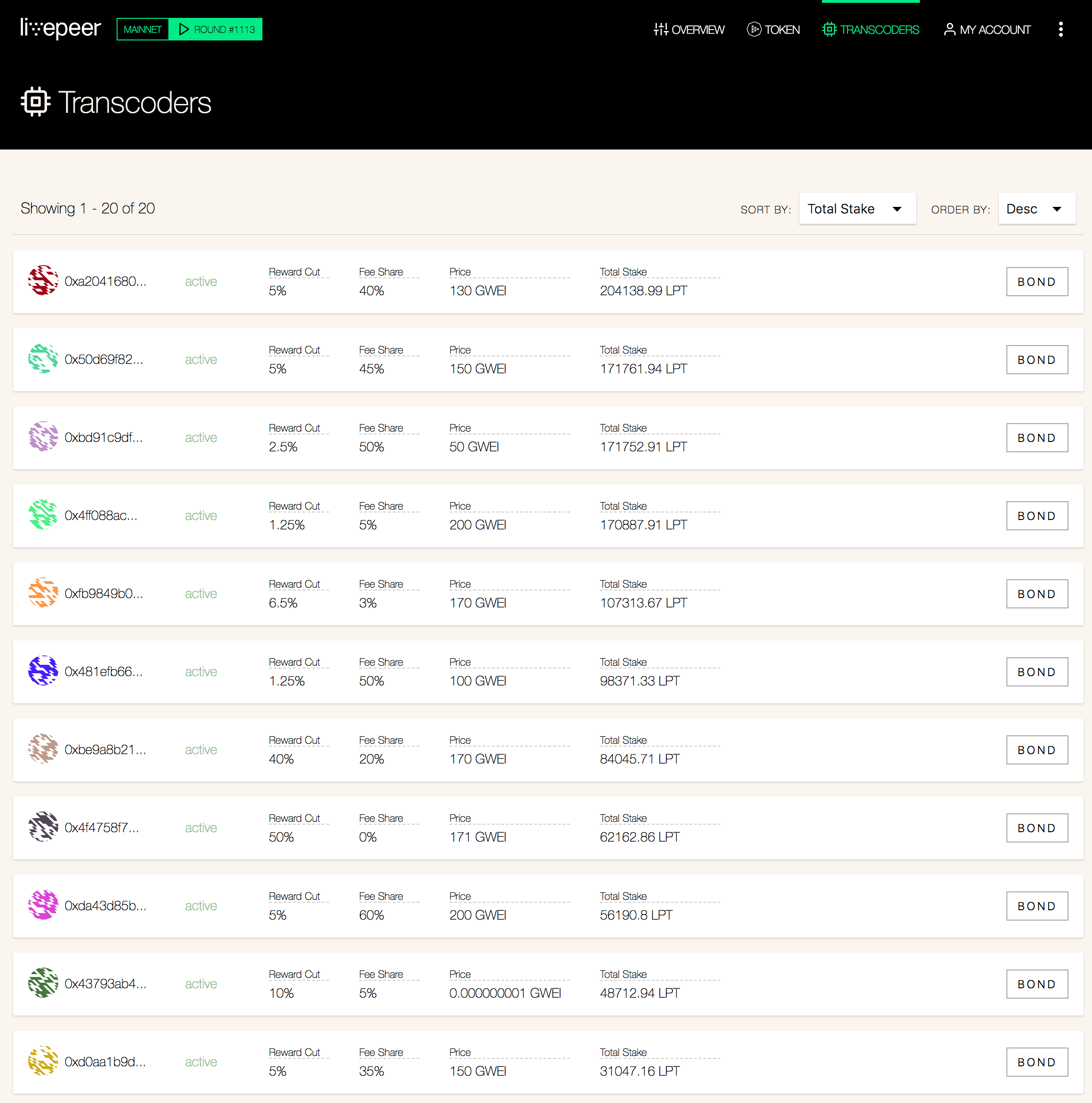

Transcoders

In the Livepeer network ‘Transcoders’ are responsible for transcoding video, which is the process of converting input streams of video from broadcasters into many different formats, and participating in the Truebit-based transcoding verification protocol.

The Livepeer network supports N (currently 15) active transcoders per round, where N is an adjustable network parameter, in addition to one randomly selected transcoder from the waitlist. Members of the active transcoder set earn inflationary rewards and broadcasting fees during each round in proportion to their total delegated stake of LPT. The active transcoder pool is reset every round based on total delegated stake.

Transcoders publish their price for transcoding a segment of video (Price Per Segment), block reward share percentage (Block Reward Cut) for newly issued LPT, and fee share percentage (Fee Share) for ETH broadcasting fees.

Transcoders need powerful hardware for efficient transcoding (potentially with GPU accelerated transcoding), high bandwidth connections for low latency video distribution, and the DevOps expertise to operate highly available, secure and reliable infrastructure for video broadcasters.

Livepeer Token (LPT)

The Livepeer Token (LPT) uses a proof-of-stake (PoS) bonding mechanism to determine the active pool of transcoder nodes, coordinate the allocation of transcoding work across validator nodes on the network, and ensure game theoretic security and performance guarantees for video transcoding and distribution. Rather than using LPT as a medium of exchange within the Livepeer network, broadcasters pay validation nodes for video transcoding and distribution services using ETH.

Token Economics

10,000,000 LPT tokens were generated in the Livepeer genesis block. New tokens are minted each round according to the protocol defined inflation schedule (relative to the outstanding float) and issued to Transcoders pro-rata based on delegated stake for performing transcoding services. Livepeer block rewards are funded by protocol defined inflation. Our Yields page displays protocol inflation as well as real yield when staking.

Transcoders can be slashed, or penalized with the loss of LPT, for failing a verification, failing to invoke a verification when required, or not performing a proportional share of transcoding work based on delegated stake.

Token Distribution

Delegation

All token holders have the option to bond, or ‘delegate’ their LPT stake to Transcoders using the Bond transaction in the Livepeer smart contract. Token holders are incentivized to delegate LPT in order to earn rewards (LPT inflation + ETH broadcaster fees) from Transcoders, and more importantly, to ensure effective Transcoders are elected and performing efficient live video broadcasting services for broadcasters.

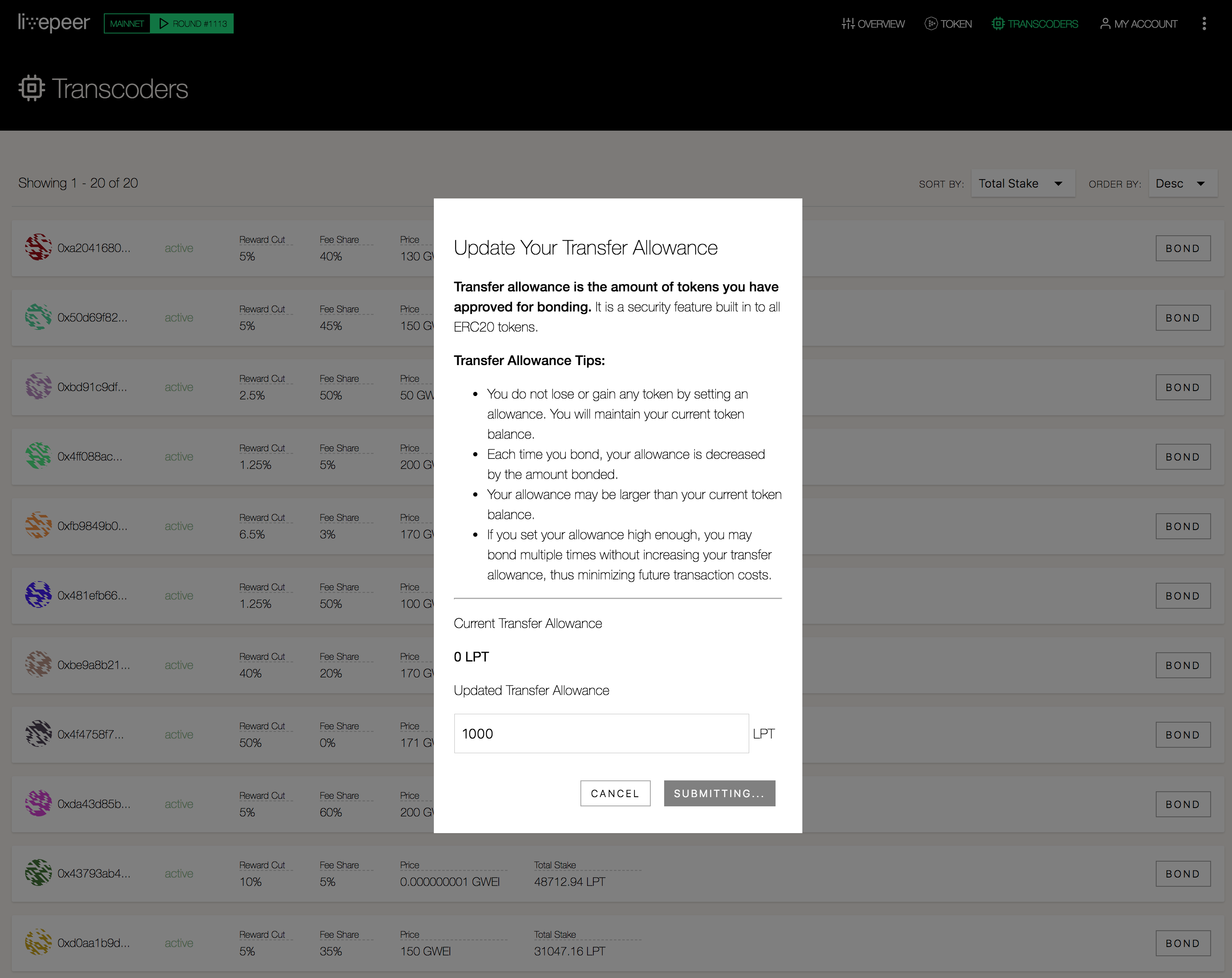

LPT Delegation Instructions

To delegate LPT to a transcoder, use the Livepeer block explorer to access a list of the active and candidate transcoders on the network and the following instructions:

Delegation is non-custodial, delegates cannot spend your LPT, and your stake is not at risk. To delegate your LPT to Staked, please use the following address:

https://explorer.livepeer.org/accounts/0xe9e284277648fcdb09b8efc1832c73c09b5ecf590xE9E284277648fcdb09B8EfC1832c73c09b5Ecf59

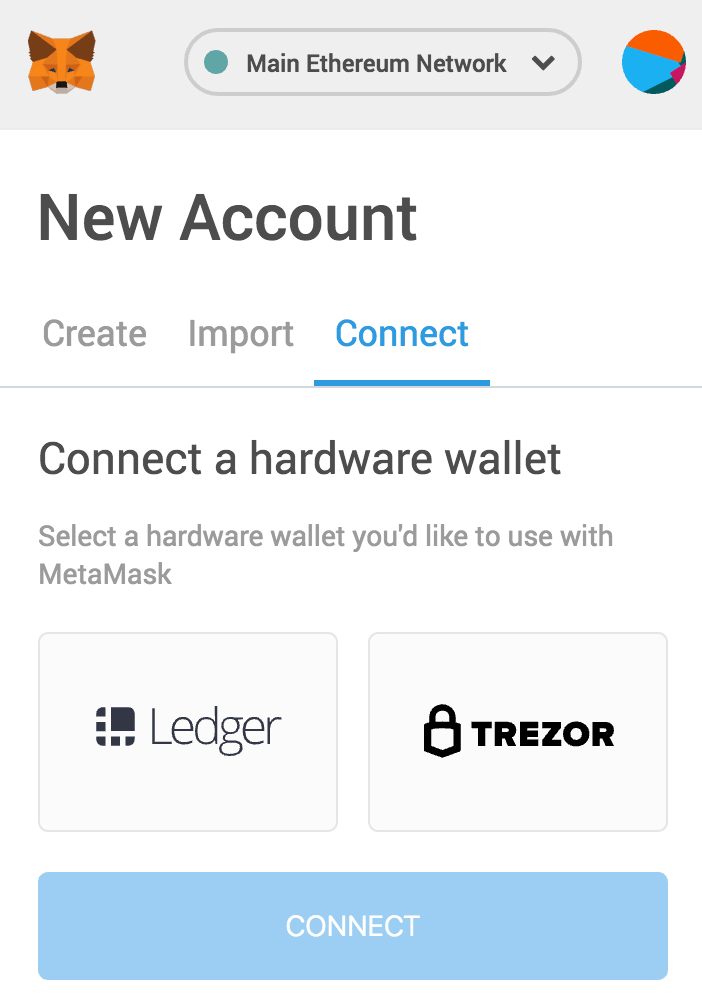

MetaMask + Hardware Wallet

It’s now possible to connect a hardware wallet to a MetaMask account for additional security.

- With your Ledger or Trezor device plugged into your computer, go to the top-right menu in MetaMask and and look for the ‘Connect Hardware Wallet’ option

- Select ‘Ledger’ or ‘Trezor’ and then click ‘Connect’

- Select the account you want to use and then click ‘Import’

About Staked

Staked operates the most secure, performant, and cost-effective block production nodes for decentralized PoS protocols on behalf of institutional investors. Our multi-tier listening and signing node architecture delivers stakeholders the ideal combination of security, scalability and decentralization.

Staked provides industrial scale staking infrastructure for leading PoS protocols including Tezos, EOS, Factom, Cosmos, Decred, R-Chain, OmiseGO, Thunder, Ethereum, Dfinity and more, allowing us to offer our customers the ideal solution for all of their staking needs.

Server Infrastructure

Staked nodes are deployed on high-performance computing resources in a multi-tier configuration that combines security and scalability while minimizing centralization on hardware providers. The infrastructure uses Kubernetes orchestration to ensure high availability and extremely low network latency, and can be scaled on-demand with network growth.

DDoS Protection

AWS Shield, Elastic Load Balancing and advanced IP address obfuscation techniques are used to defend against malicious network, transport and application layer denial of service attacks.

Listening Cloud

The listening cloud is comprised of publicly accessible nodes that dynamically allocate resources from multiple cloud service providers, including AWS, Google Cloud and Azure. Orchestrated by Kubernetes, the listening cloud enables near-infinite scale, self-healing and a decentralized hardware infrastructure.

Signing Servers

The signing servers are bare metal servers responsible for producing and signing blocks. They are secured in Equinix data centers in the United States, have hardware signing modules for key security, and are fire-walled so they can only communicate with the listening servers.

Tezos (XTZ) Baking & Delegation Guide

Tezos (XTZs) need to be delegated to a baker to earn block rewards. Staked offers an anonymous and fully automated delegation service for Tezos baking. We post the required bond for baking and charge a 10% baking fee.

Delegation is non-custodial, delegates cannot spend your money (XTZs), and your stake is never at risk. To delegate your XTZ to Staked, please use the following address:

tz1RCFbB9GpALpsZtu6J58sb74dm8qe6XBzv

Token Economics

Effective yield estimates based on a 62.5 second block interval.

Effective yield estimates based on a 62.5 second block interval.About

The Tezos blockchain protocol is a delegated proof-of-stake system that supports Turing complete smart contracts. Tezos is implemented in OCaml, a functional programming language that offers speed, an unambiguous syntax and semantics, and formal proofs of correctness.

Launch

The Tezos betanet was launched on June 30th, 2018, and started processing real transactions that will persist on ‘mainnet’. The Tezos Foundation was responsible for all block production and validation during the first seven cycles, approximately three weeks. On July 21st, 2018, the first non-Tezos Foundation, or ‘community’ block was baked.

Baking & Endorsing

Baking is what Tezos refers to as the action of signing and publishing a new block in the chain. Bakers need at least 10,000 XTZ (~ $22,000) to qualify as a delegate, and having additional delegated stake increases their chances of being selected as a Baker or Endorser.

At the beginning of each cycle (4096 blocks or ~ 3 days), the Bakers for each block are randomly selected and published. Bakers earn a block reward of 16 XTZ for baking a block.

In addition to the Baker, 32 Endorsers are randomly selected to verify the last block that was baked. Endorsers receive 2 XTZ for each block they endorse.

Block Rewards & Inflation

Block rewards are funded by protocol defined inflation. Rewards are calibrated so that the number of XTZ tokens grows at roughly 5.5% per year. If 100% of Tezos tokens are delegated, the annualized yield will be 5.5%. Currently, 38% of Tezos tokens have been delegated, including the 10% owned by the Tezos Foundation, so the annualized yield is currently 14%.

To ensure Bakers and Endorsers act honestly, they are required to post a security deposit for each block they Bake or Endorse. They forfeit this deposit in the event of malicious activity, such as double baking or double endorsing a block.

Governance

Protocol amendments are adopted over election cycles 131,072 blocks, or ~3 months. This cycle is expected to increase in length as the protocol matures. A quorum of 80% is required for governance proposals.

XTZ Activation and Delegation Instructions

To choose a Delegate and participate in Tezos’s proof-of-stake mechanism, you will need to first activate your XTZ Allocation, create an account for delegating that stake, and specify the public delegate key responsible for taking part in baking and governance on your behalf. You can change the delegate at any time, though the change only becomes effective after N cycles.

- Activate your XTZ allocation on the genesis block with Activatez, a simple tool to quickly and securely activate your XTZ without having to remove your private data from cold storage

- Create a TezBox wallet with your fundraiser information: visit TezBox, select ‘Restore Tezbox’, and then ‘Fundraiser Wallet’

- Input your information: PDF seed words, PDF email address, ICO password, and KYC activation code

- Create a new KT1 account (a special account for delegation) by clicking the ‘Add Account’ button (fee: 0.25 XTZ)

- Move your XTZ from your tz1 account to your KT1 account. From the main wallet select ‘Send’, enter your KT1 address in the ‘To’ address, enter an XTZ amount, and click ‘Send’ (leave fee field blank)

- In the KT1 account, select the ‘Delegate’ menu and then choose ‘Custom delegate’

- Input address: tz1RCFbB9GpALpsZtu6J58sb74dm8qe6XBzv and click to confirm