Summary

Livepeer offers a very attractive staking yield: currently ~ 77% on an annualized basis.

If you own Livepeer (LPT), it’s advisable to bond it to a transcoder so that you can earn the staking yield. To delegate your LPT to Staked, please use the following address:

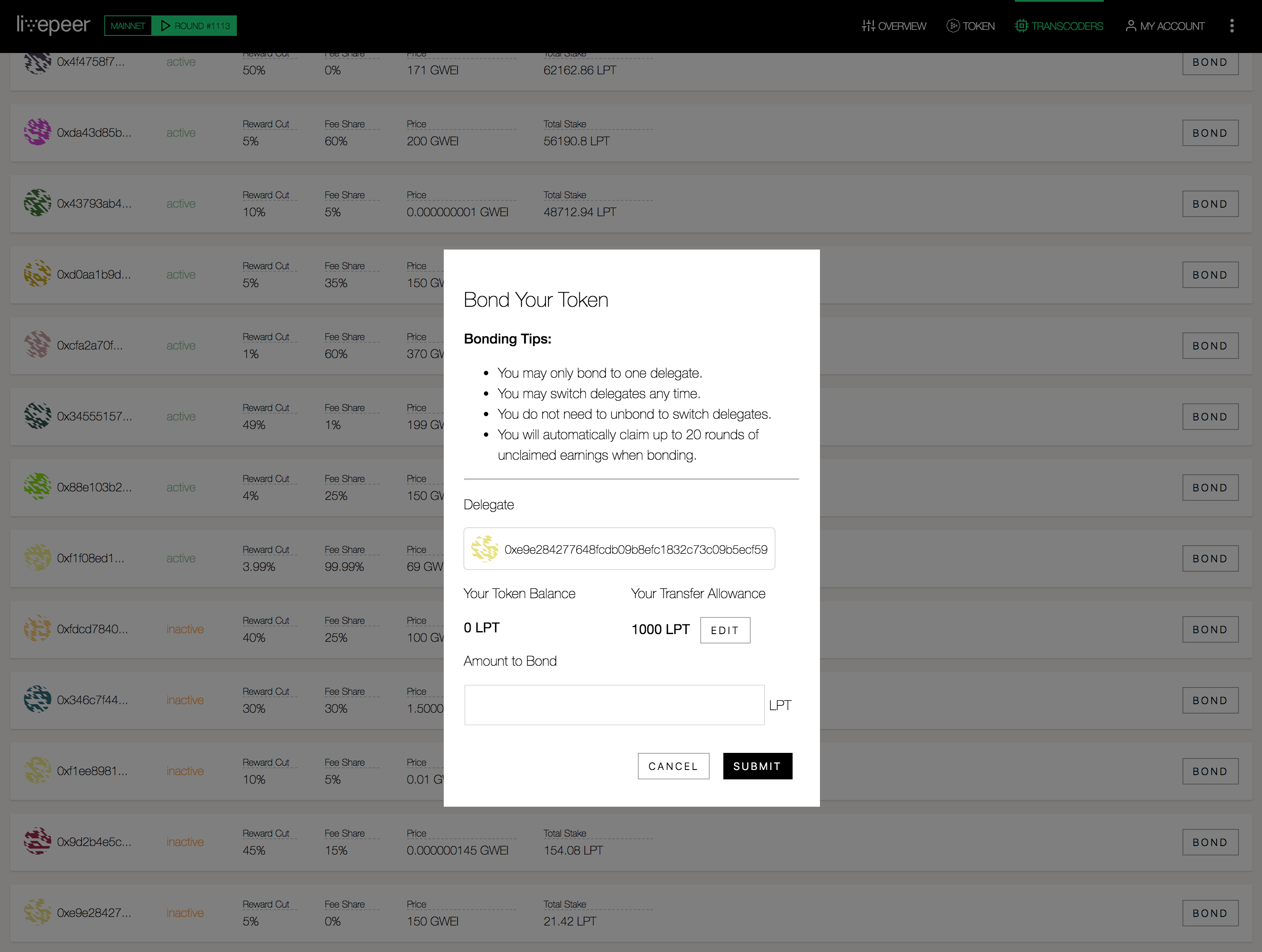

0xe9e284277648fcdb09b8efc1832c73c09b5ecf59

Delegation is non-custodial, delegates cannot spend your LPT, and your stake is not at risk.

Overview

Livepeer aims to decentralize live video broadcast by developing a live video streaming (p2p) network protocol and infrastructure layer on the Ethereum blockchain. The Livepeer protocol is designed to incentivize game theoretically secure, performant and scalable transcoding and distribution of live video. The Livepeer alpha network launched on the Ethereum mainnet on May 1, 2018.

The Livepeer protocol is round based, where each round lasts roughly one day. Token holders delegate their stake to elect transcoder nodes that perform video transcoding work.

At the completion of each round, broadcaster fees and newly minted (via inflation) LPT are distributed, transcoders are slashed (penalized with loss of funds) for any malicious activity, and the active transcoder pool is reset based on total delegated stake, all programmatically at the protocol level.

Transcoders

In the Livepeer network ‘Transcoders’ are responsible for transcoding video, which is the process of converting input streams of video from broadcasters into many different formats, and participating in the Truebit-based transcoding verification protocol.

The Livepeer network supports N (currently 15) active transcoders per round, where N is an adjustable network parameter, in addition to one randomly selected transcoder from the waitlist. Members of the active transcoder set earn inflationary rewards and broadcasting fees during each round in proportion to their total delegated stake of LPT. The active transcoder pool is reset every round based on total delegated stake.

Transcoders publish their price for transcoding a segment of video (Price Per Segment), block reward share percentage (Block Reward Cut) for newly issued LPT, and fee share percentage (Fee Share) for ETH broadcasting fees.

Transcoders need powerful hardware for efficient transcoding (potentially with GPU accelerated transcoding), high bandwidth connections for low latency video distribution, and the DevOps expertise to operate highly available, secure and reliable infrastructure for video broadcasters.

Livepeer Token (LPT)

The Livepeer Token (LPT) uses a proof-of-stake (PoS) bonding mechanism to determine the active pool of transcoder nodes, coordinate the allocation of transcoding work across validator nodes on the network, and ensure game theoretic security and performance guarantees for video transcoding and distribution. Rather than using LPT as a medium of exchange within the Livepeer network, broadcasters pay validation nodes for video transcoding and distribution services using ETH.

Token Economics

10,000,000 LPT tokens were generated in the Livepeer genesis block. New tokens are minted each round according to the protocol defined inflation schedule (relative to the outstanding float) and issued to Transcoders pro-rata based on delegated stake for performing transcoding services. Livepeer block rewards are funded by protocol defined inflation. Our Yields page displays protocol inflation as well as real yield when staking.

Transcoders can be slashed, or penalized with the loss of LPT, for failing a verification, failing to invoke a verification when required, or not performing a proportional share of transcoding work based on delegated stake.

Token Distribution

Delegation

All token holders have the option to bond, or ‘delegate’ their LPT stake to Transcoders using the Bond transaction in the Livepeer smart contract. Token holders are incentivized to delegate LPT in order to earn rewards (LPT inflation + ETH broadcaster fees) from Transcoders, and more importantly, to ensure effective Transcoders are elected and performing efficient live video broadcasting services for broadcasters.

LPT Delegation Instructions

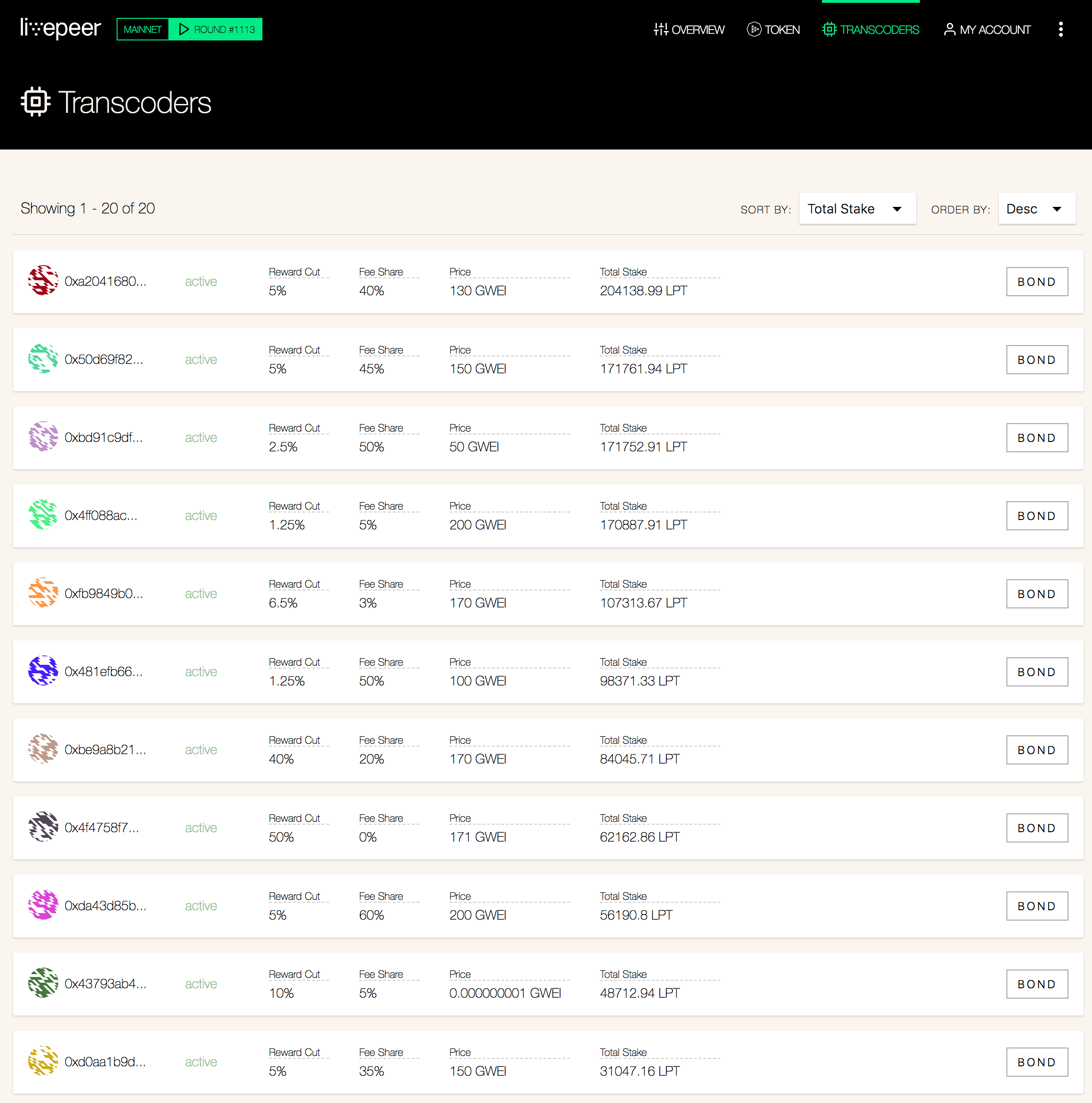

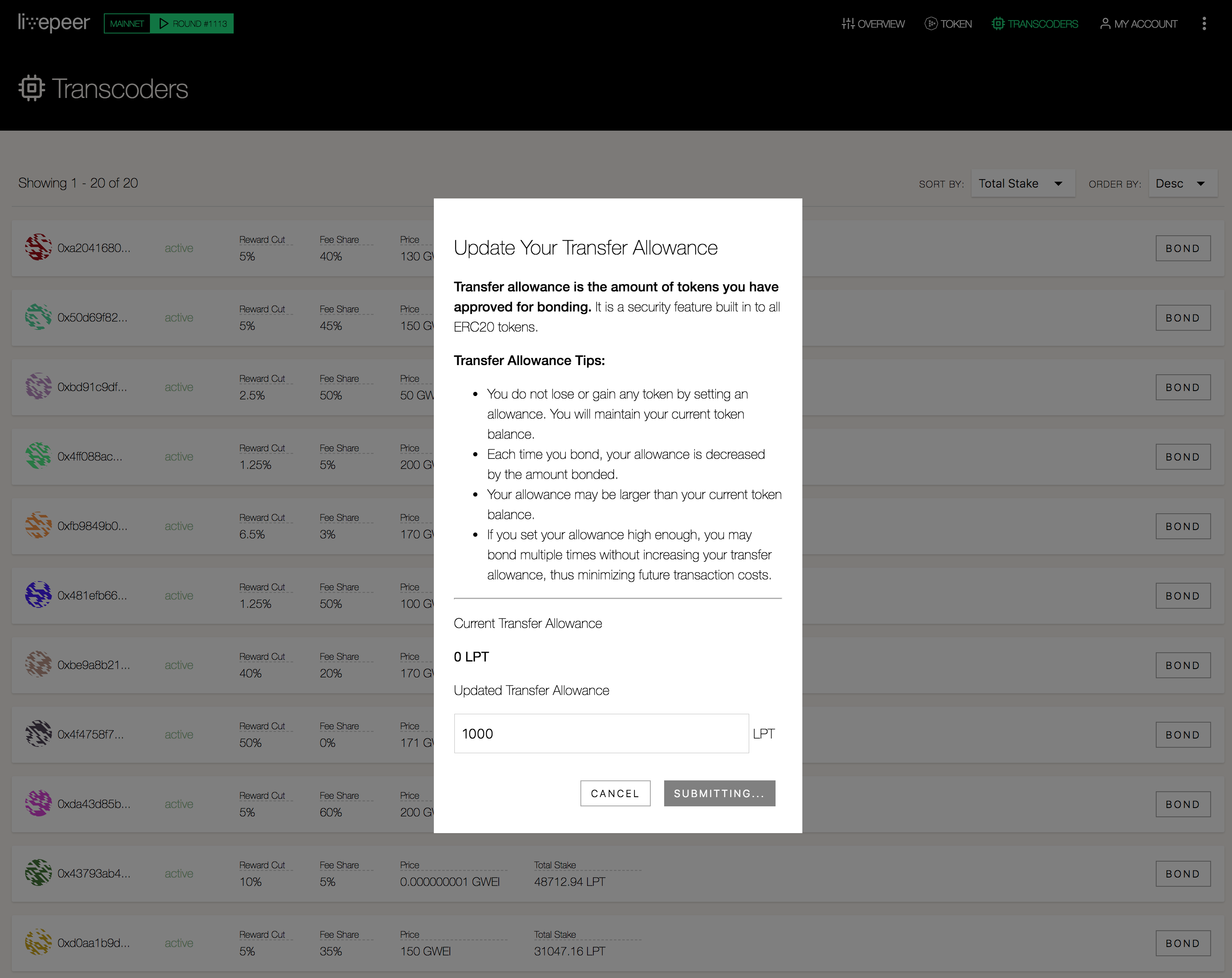

To delegate LPT to a transcoder, use the Livepeer block explorer to access a list of the active and candidate transcoders on the network and the following instructions:

Delegation is non-custodial, delegates cannot spend your LPT, and your stake is not at risk. To delegate your LPT to Staked, please use the following address:

https://explorer.livepeer.org/accounts/0xe9e284277648fcdb09b8efc1832c73c09b5ecf590xE9E284277648fcdb09B8EfC1832c73c09b5Ecf59

MetaMask + Hardware Wallet

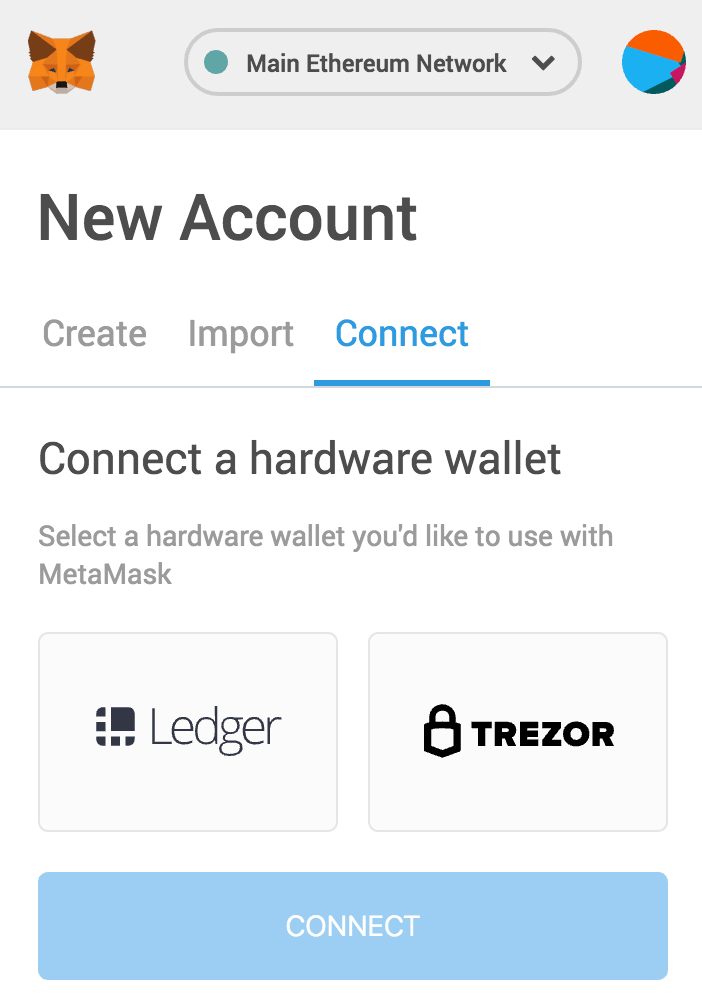

It’s now possible to connect a hardware wallet to a MetaMask account for additional security.

- With your Ledger or Trezor device plugged into your computer, go to the top-right menu in MetaMask and and look for the ‘Connect Hardware Wallet’ option

- Select ‘Ledger’ or ‘Trezor’ and then click ‘Connect’

- Select the account you want to use and then click ‘Import’

About Staked

Staked operates the most secure, performant, and cost-effective block production nodes for decentralized PoS protocols on behalf of institutional investors. Our multi-tier listening and signing node architecture delivers stakeholders the ideal combination of security, scalability and decentralization.

Staked provides industrial scale staking infrastructure for leading PoS protocols including Tezos, EOS, Factom, Cosmos, Decred, R-Chain, OmiseGO, Thunder, Ethereum, Dfinity and more, allowing us to offer our customers the ideal solution for all of their staking needs.

Server Infrastructure

Staked nodes are deployed on high-performance computing resources in a multi-tier configuration that combines security and scalability while minimizing centralization on hardware providers. The infrastructure uses Kubernetes orchestration to ensure high availability and extremely low network latency, and can be scaled on-demand with network growth.

DDoS Protection

AWS Shield, Elastic Load Balancing and advanced IP address obfuscation techniques are used to defend against malicious network, transport and application layer denial of service attacks.

Listening Cloud

The listening cloud is comprised of publicly accessible nodes that dynamically allocate resources from multiple cloud service providers, including AWS, Google Cloud and Azure. Orchestrated by Kubernetes, the listening cloud enables near-infinite scale, self-healing and a decentralized hardware infrastructure.

Signing Servers

The signing servers are bare metal servers responsible for producing and signing blocks. They are secured in Equinix data centers in the United States, have hardware signing modules for key security, and are fire-walled so they can only communicate with the listening servers.